Latin America & the Caribbean

Region

LATIN AMERICA & THE CARIBBEAN

Latin American countries continue to be at the forefront in clean energy development among the nations assessed in Climatescope. Ambitious clean energy mandates and aggressive auctions are driving deployment in the region and allowing wind and solar projects to achieve record low prices. Markets are opening to new opportunities and engagements with the private sector. Investment is reaching new records and markets are adopting innovative finance instruments, like green bonds. Clean energy is opening new frontiers for service providers and equipment manufacturers, expanding the reach of the industry.

Still, the nascent industry faces challenges. Policymakers and energy planning agencies must adjust to the new dynamics presented by renewable projects. Meanwhile, entrepreneurs are learning to navigate macroeconomic and project-level risks. Investors and financiers are adapting to clean energy projects-specific requirements.

This marks the first Climatescope in which Brazil has not secured the top ranking in the Latin America and Caribbean region. The country’s score is up over last year but did not rise at the pace of some other Latin America and Caribbean nations. While Brazil remains one of the top 10 global clean energy markets, its macroeconomic and political crisis has taken a significant toll on its renewable energy industry.

This year, for the first time, Chile occupies the first position in Latin America, mainly due to record investment, which jumped from $1.3bn in 2014 to $3.2bn in 2015. Renewables have had a big impact on Chile’s power sector, contributing to a drop of wholesale prices but also aggravating transmission congestion issues. With Brazil ranked second, Uruguay rounds out the top three thanks to high participation of renewables in the country’s matrix. Uruguay’s clean energy market is to a large degree now saturated, but the country still has plenty of work ahead in cutting greenhouse gas emissions.

RENEWABLE ENERGY CAPACITY

Latin America and the Caribbean (LAC) boasts higher clean energy penetration than any region assessed in Climatescope. As of year-end 2015, 12% of the 366GW installed in LAC was represented by biomass, wind, small hydro, solar and geothermal power-generating projects. These sources accounted for 10% of total installed capacity in the Asian countries covered by Climatescope, 3% in African countries and less than 1% in Middle Eastern and North African (MENA)1 nations. If we include large hydro in the mix, 56% of Latin America’s power grid is renewable. However, hydro generation overreliance has brought issues to several countries in the region.

Historically, Brazil, Costa Rica, Uruguay and Panama have all suffered from droughts that have put their power matrices under severe stress. Most recently, Colombia and Venezuela faced crisis due to lower than expected hydro generation.

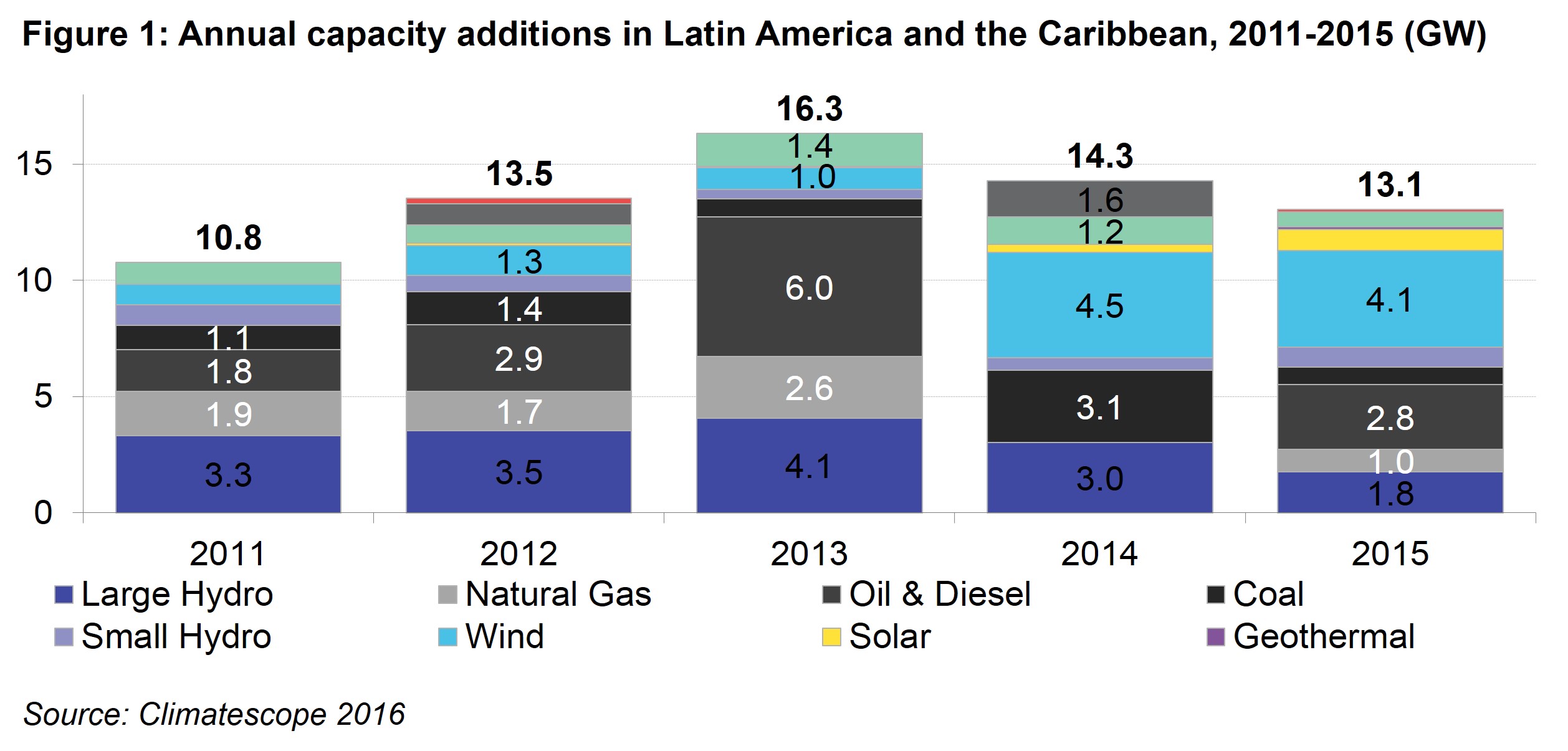

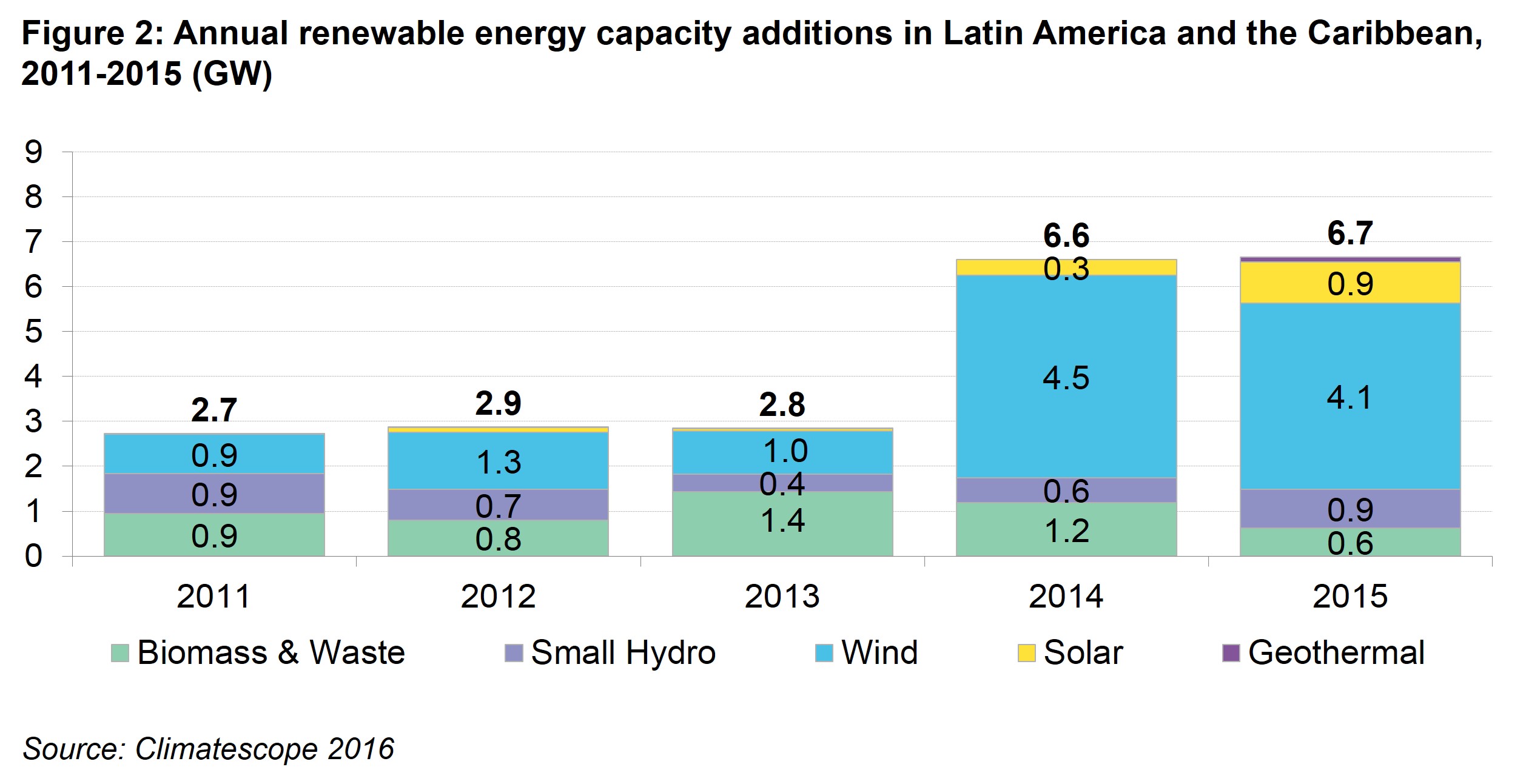

All of this has moved countries to contemplate energy diversification and support development of non-hydro renewables. This trend accelerated in 2014 (Figure 1 and Figure 2). And in 2015, wind, solar, small hydro, geothermal and biomass plants accounted for half of the 13GW of new capacity added in the region. The bulk came from wind (4.1GW), mostly in Brazil(2.6GW), Mexico (769MW), Uruguay (376MW) and Panama (150MW) and the market is expected to continue growing. In the next five years, Bloomberg New Energy Finance (BNEF) expects 22.5GW of new wind to be added in Latin America.

Solar projects still represent just a small share of commissioned capacity in the region but this is expected to change in coming years. BNEF foresees 9GW of utility-scale PV installed in Latin America between 2016 and 2018.

Despite the relatively small figures, 2015 set a record for PV capacity added, at 0.9GW. Over 40% of that came in tiny Honduras, driven by a generous feed-in tariff of $180/MWh for plants commissioned by 31 July 2015. Chile was second, with 305MW of solar added.

RENEWABLE ENERGY TARGETS

Latin America and Caribbean governments are stepping up support for clean energy. In 2015, the number of nations with renewable energy targets nearly doubled compared to the year before and included 18 of 26 nations surveyed for Climatescope in the region. This is up from just 10 countries in 2014. The drivers: the Paris agreement and the Intended National Determined Contributions (INDC) submitted to the United Nations in 2015.

Still, targets, compliance and ambition vary substantially among countries. Brazil is sticking to its conservative target as renewables uptake has been extremely successful to date. Peru, on the other hand, has failed to review its renewable portfolio standard, despite the fact it essentially expired in 2013. Nicaragua has the extremely ambitious target of having renewables account for 91% of consumption by 2027 (up from 50% in 2015).

Finally, there are a number of countries where clean energy development has far exceeded original national targets. Uruguay, for instance, aimed to reach 15% of clean energy installed capacity by 2015 but more than doubled that to 34% last year. The country now aims to meet up to 38% of its electricity needs with wind energy alone by 2017.

CLEAN ENERGY POLICY

Latin America has led the world in its use of auctions to contract clean energy capacity and generation. Back in 2009, Brazil was one of the first to adopt auctions to contract renewables. At the time, this was novel compared to feed-in tariff schemes used in a number of European countries. Today, a total of 13 countries in Latin America and the Caribbean have adopted auctions and tenders as the main way to contract clean power – a trend that is also spreading globally (see Parameter I summary).

Auctions introduce a competitive element that pushes developers to deliver the best price possible under long-term power purchase agreements (PPAs). Clean energy projects are very capital-intensive at the development stage. Long-term contracts provide revenue certainty that helps developers to reduce project risk and improve financing conditions. The auctions have led to steep price declines across the region as developers fight for contracts.

However, auction mechanisms must be closely watched for irrational bidding or, worse still, market rigging. Brazil saw the former with its 2014 solar-specific auctions. Developers bid very aggressively for contracts, offering prices which at the time were feasible but would generate for them only very tight returns.

Shortly thereafter, the Brazilian economy went into a tailspin and its currency collapsed vs. the dollar. Developers that would have achieved narrow returns suddenly found themselves with projects and contracts that could not produce profits. Brazil stands as a cautionary tale of how market conditions can rapidly shift and catch developers – and policy-makers – off guard.

Similar risks could be taken into account in other nations with potentially volatile macroeconomic environments. In this respect, the recent trend toward allowing power purchase agreements to be signed in dollars is a welcome move.

While utility-scale clean energy installations are driven by auctions, net metering policies are helping the nascent Latin American distributed generation market grow. Net metering regulation has significantly increased in the region in the past two years. Currently, 11 countries have net metering policies in place, compared to just seven in 2013.

The benefits of self-generation policies are clearly seen in island nations heavily dependent on fossil fuels for energy generation and with high solar irradiation. Four of the six Caribbean islands reviewed in Climatescope have net metering policies in place. This figure is also high in Central America, where four of seven countries have self-generation policies enacted, but low in South America, where Brazil, Chile and Uruguay are the only markets in which users are allowed to sell their excess generation to the grid.

EMISSIONS’ REDUCTION TARGETS

Compelled by the Paris talks, last year 24 Latin America and Caribbean countries submitted plans to the UN to address climate change. Among these, 20 included specific greenhouse gas (GHG) emission reduction targets, which are split into three types of commitments:

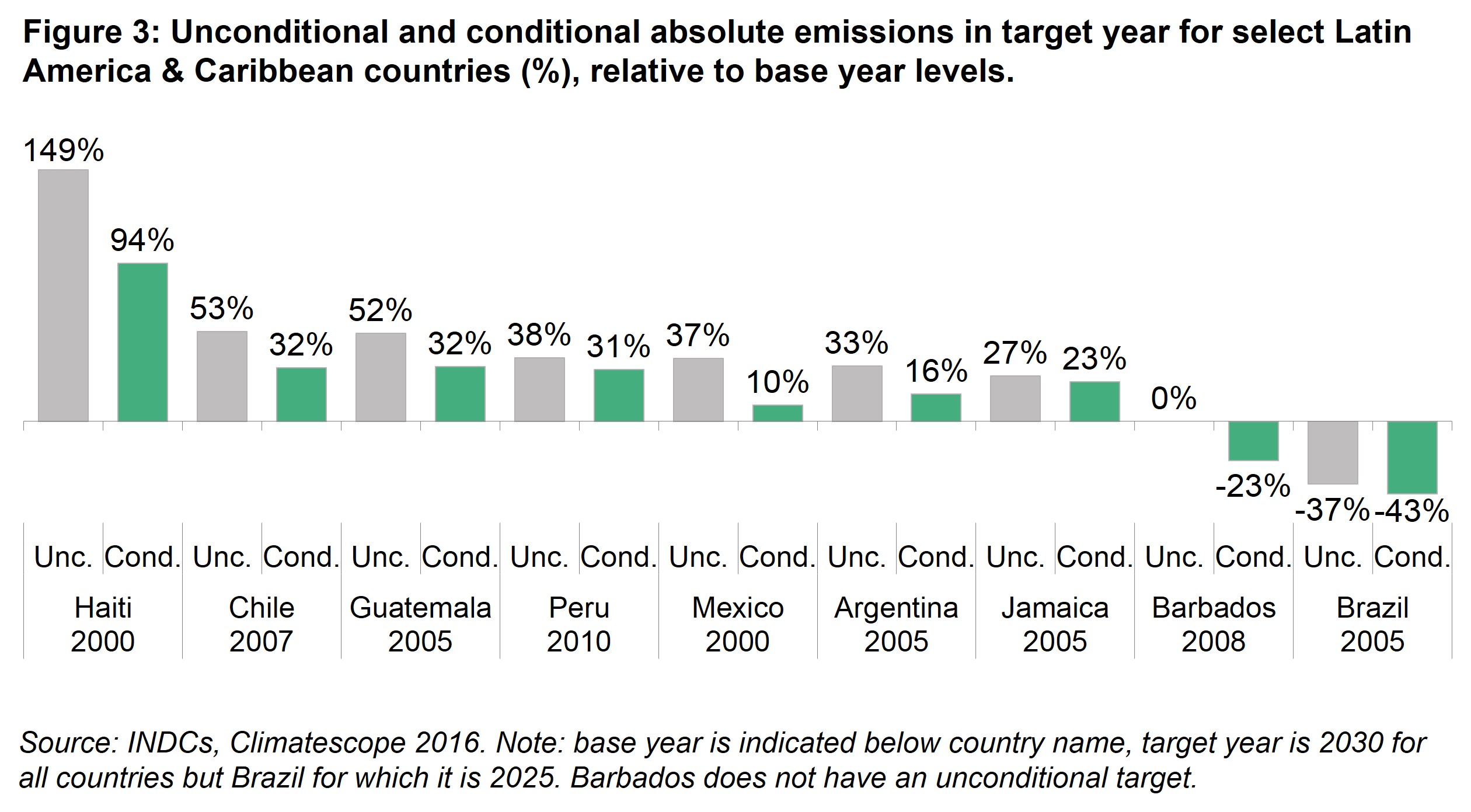

- Absolute targets are relative to real emissions in a base year and therefore are a commitment to an absolute reduction. Brazil and Costa Rica submitted absolute targets. Brazil, for instance, has committed to cut greenhouse gas emissions 37% below 2005 levels by 2025.

- Intensity targets are relative to GHG emissions per unit of GDP. Chile and Uruguay submitted intensity targets. Chile, for instance, has committed to cut greenhouse gas emissions by GDP unit by 30% below the 2007 level by 2030. We estimate that this will result in over 50% growth in emissions over the period.

- Business as usual targets (BAU) are relative to a BAU scenario, which is projected considering future economic and population growth and therefore result in an increase in emissions in absolute terms (Figure 3). Sixteen Latin America and Caribbean countries surveyed in Climatescope submitted BAU targets. Haiti, for instance, has committed to cut greenhouse gas emissions by 5% below the BAU by 2030. This implies an absolute increase in emissions of 149% by the target year. Targets can be conditional, unconditional or a combination of both. Conditional commitments are subject to international support while unconditional commitments rely on domestic resources alone. Nine countries in the region have disclosed detailed unconditional and conditional targets (Figure 3).

Brazil has one of the world’s most ambitious targets. The country’s commitment to cut greenhouse gas emissions 37% below 2005 levels by 2025 can rise to 43% if the country receives international support. That would translate to 903MtCO2e reduction by 2025 compared to 2005. This figure is three times the amount emitted in 2012 by the 13 Central American and Caribbean countries combined.

Costa Rica is the only country in the region, and one of a handful in the world, that has included a carbon neutral component in its INDC. The carbon neutrality commitment was first announced back in 2007 as part of the country’s National Climate Change Strategy. Costa Rica may use its Domestic Carbon Market as a complement to national and sectoral policies for emissions reduction in order to achieve this goal.

Latin American and Caribbean countries will have to considerably increase the reach of their carbon offset regulations and activities to meet their targets. Currently, only two countries have carbon tax policies in force, both enacted in 2014. Chile has approved a $5/t tax on CO2 and will begin to measure emissions in 2017. Collections of the tax are expected to start the following year. Mexico has introduced a carbon tax on the sale and import of fossil fuels. Additionally, Mexican-based companies with yearly emissions over 100Mt must provide performance information to the National Register of Emissions and have their annual reports verified by a third party organization authorized by the government.

INVESTMENT

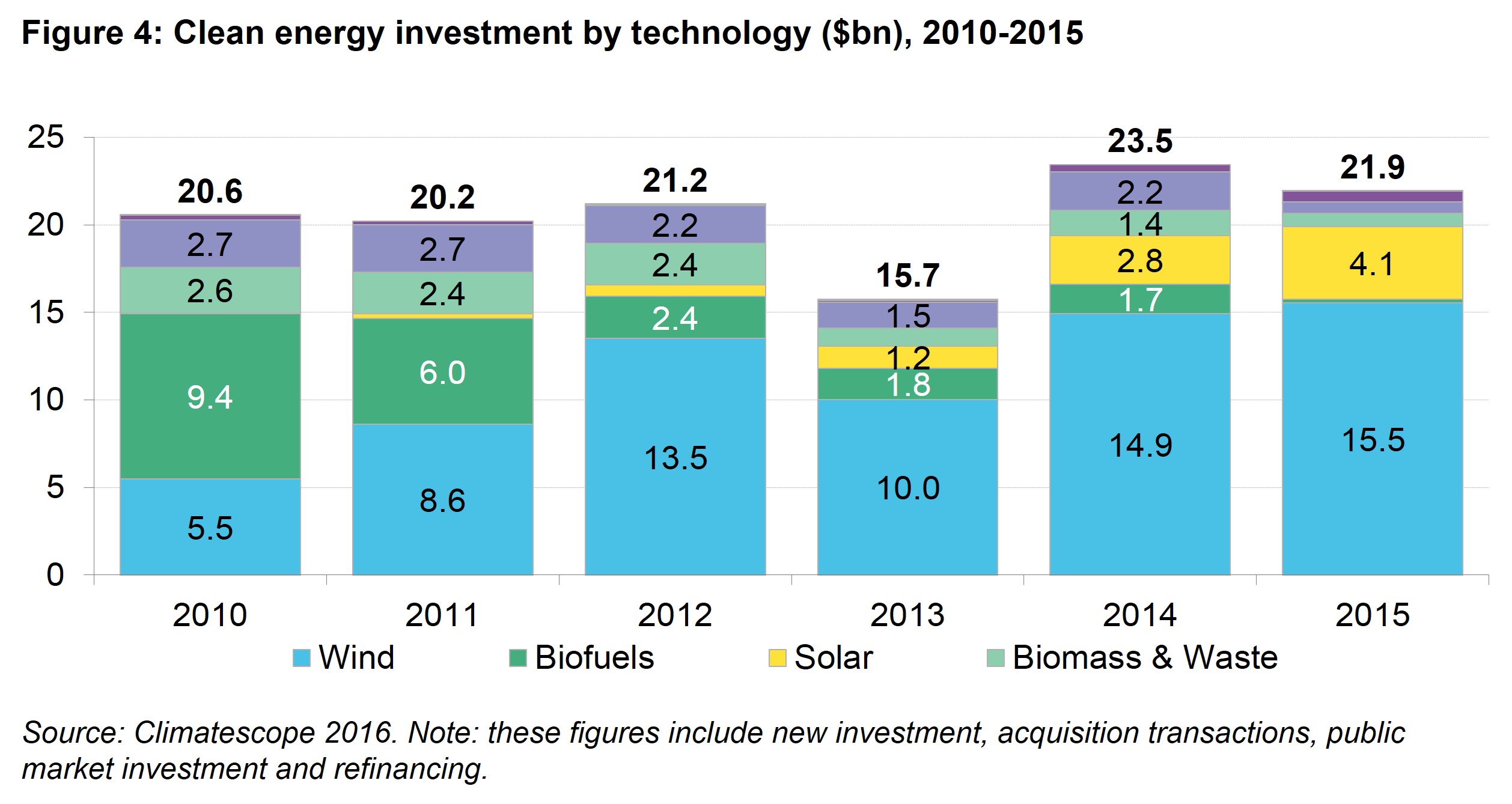

Wind continued to attract the bulk of investment in 2015 with $15.5bn (Figure 4). Activity in solar, which kicked off in 2012, continued to grow steadily in 2015 to reach $4.1bn. Small hydro and biomass have been traditional clean energy sectors in the region. While these technologies did not attract growing amounts of investment, they continued to be relevant given LAC’s hydro resources and agriculture production.

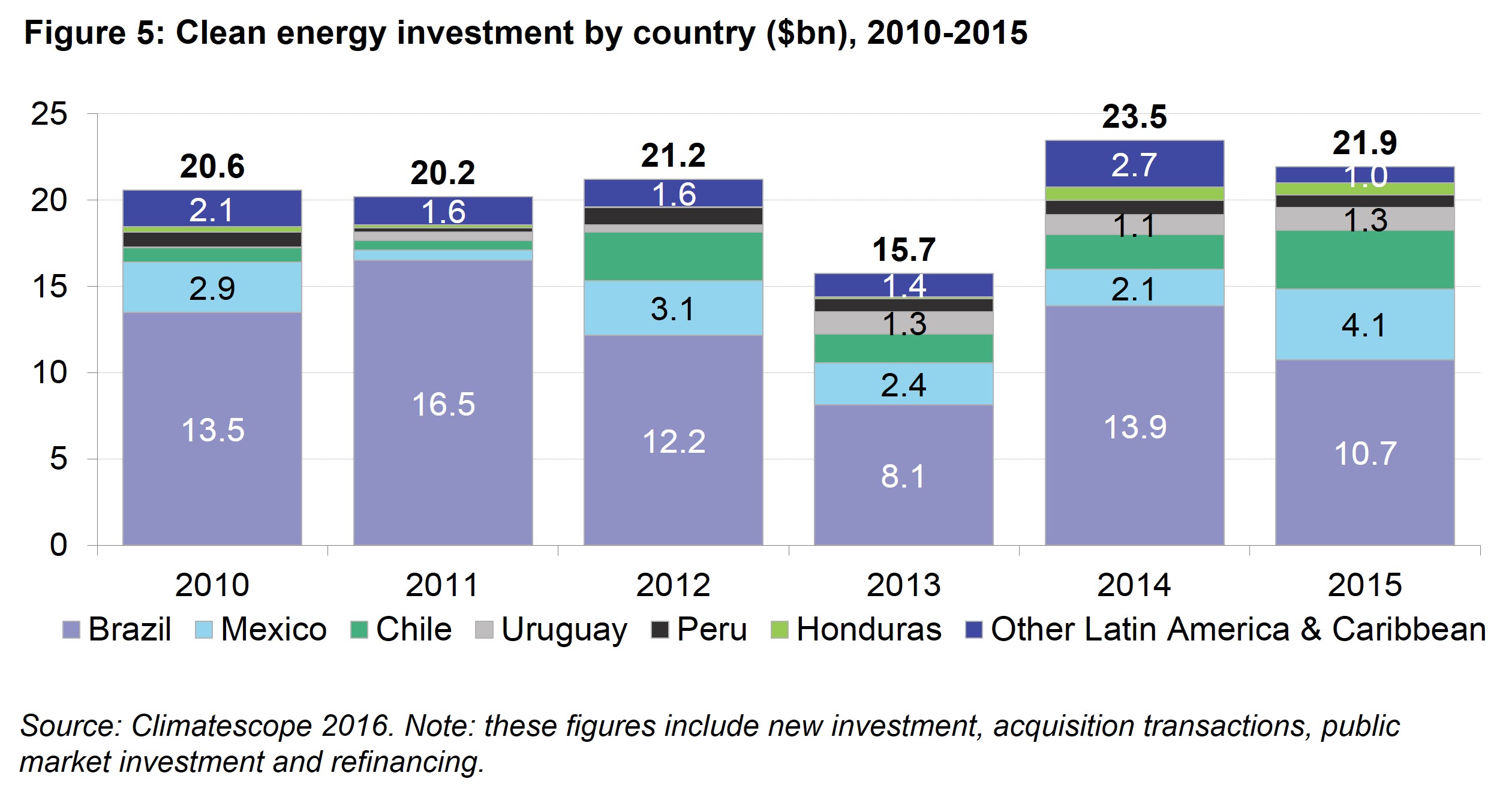

In terms of geography, Brazil, the largest power market in Latin America, continues to lead regionally in terms of amount of investment, registering $10.7bn of new funds for renewables in 2015. However, geographic diversification continues.

Last year, Mexico ($4.1bn) and Chile ($3.4bn) were the 2nd and 3rd largest renewable investment destinations (Figure 5). Much smaller countries have gone through waves of investment given the size of their economies and power grids. For instance, Honduras saw a surge of $675m invested last year and Jamaica received $205m for renewable energy projects, compared to only $3m in 2014. These countries will be unable to sustain such levels of investment on a yearly basis, but their successes in 2015 demonstrate how the clean energy map has expanded.

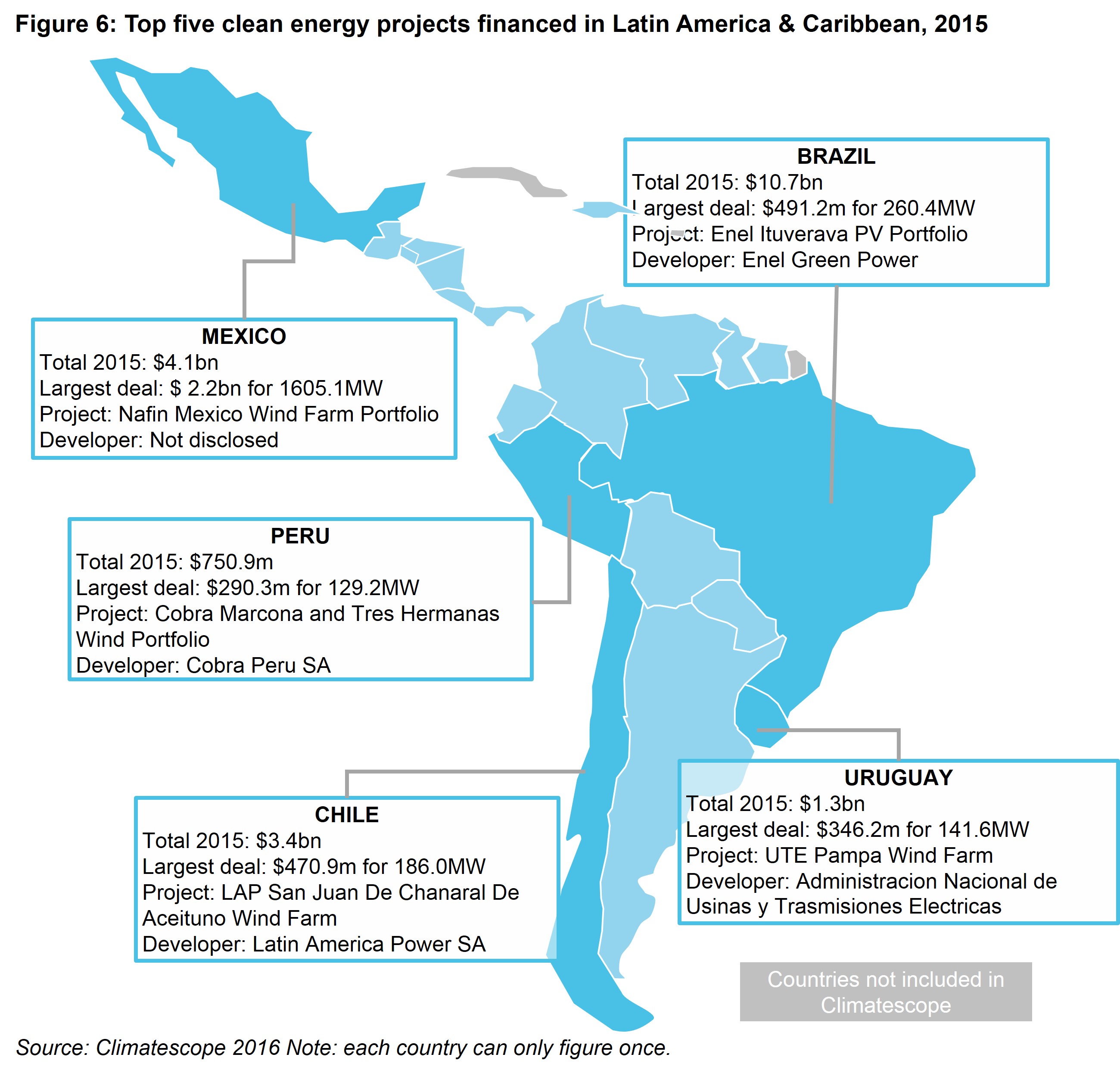

Other notable trends include the entry of new financiers into the region and some financial innovation. Historically, development banks and multilateral institutions have dominated financing of clean energy projects in the region. As the market has grown, international and local private banks have stepped up. As for innovation, one area of growth has been greater use of green bonds. Last year, a major offering in Mexico by development bank NAFIN accounted for most of the clean energy investment in the country (Figure 6). Green bonds have been an interesting instrument for institutional investors to tap into the clean energy market.

MARKETS IN TRANSFORMATION

The first half of 2016 has been marked by significant policy progress in Argentina, Brazil, and Mexico. Colombia is one of the last markets in Latin America that has yet to open its power sector to clean energy. These are four countries to watch for next year’s Climatescope.

After a decade of nearly no activity, Argentina is angling to become a renewable investment destination. At the end of 2015, the government published a new renewable energy law (27.191). Several months later, the government issued accompanying regulations, marking a turning point for its clean energy industry. The law raised the country’s national target to 8% of power consumption by 2017. This will be challenging to reach, since clean energy only represented 2% of 135TWh generated in 2015. The government is aiming to at least contract sufficient capacity to meet the goal the following year.

With an eye toward achieving that, Argentina followed its neighbors in launching a new auction mechanism, which contracted 1.1GW of wind and solar capacity in October 2016. The next renewable energy auction is expected to be held in April 2017.

Brazil’s crisis has hurt the country’s renewable energy industry primarily through exchange rate volatility. It has also led policy-makers to rethink the structures of energy planning, regulation and financing. Conversations are now underway about strengthening the country’s auction system and improving transmission planning and market certainty. Additionally, there is a push to seek new financing options and move away from overreliance on the country’s development bank, BNDES.

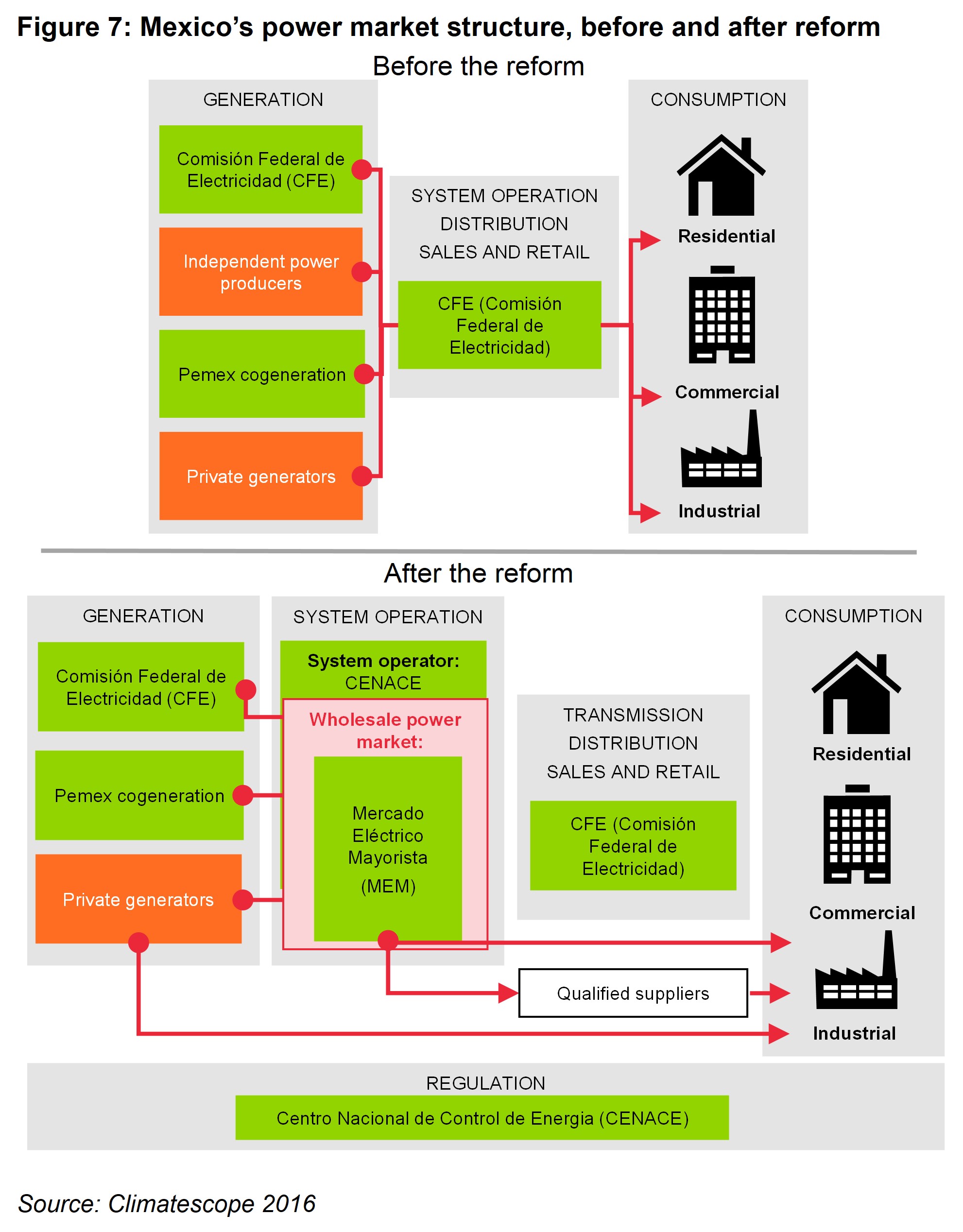

Mexico is in the process of implementing its energy reform, which should be completed by 2018 (Figure 7). The country’s newly introduced auctions have attracted international investors and produced the lowest average tendered prices for wind and solar contracts seen globally. Its nascent wholesale market, which launched at the beginning of 2016, is gaining liquidity. Once it is fully implemented, we expect a new wave of investment in clean energy projects.

Between 2015 and 2016, Colombia endured one of its worst droughts, driven by the ‘El Niño’ phenomenon. This significantly impaired the country’s power matrix, which is 70% composed of hydro plants. We expect that this will lead Colombia to re-consider its grid planning and seek greater diversification in its energy mix, potentially creating new opportunities for renewables.

A CLOSER LOOK AT THE CARIBBEAN

Caribbean island nations remain largely dependent on fossil fuels. However, some are taking important strides toward transitioning to a cleaner energy future.

In 2008, Jamaica became the first Caribbean country to hold a clean energy-specific auction. Its National Energy Plan calls for 20% of generation to come from renewables by 2030. A significant jump in clean energy investment, along with greater value chain penetration, have moved Jamaica up in the Climatescope rankings.

Barbados serves as an example of how well-structured policy incentives can boost demand for distributed renewable energy and reduce utility-scale generation. In 2013, the country published an extensive tax incentive policy to benefit activities related to renewable energy, particularly self-generation. The Barbados net metering regulation has been in force since 2010 and has since been modified to quadruple the program’s capacity cap. Solar self-generation systems will soon meet 8% of the country’s electricity needs. This has led to a 7% cut in generation from thermal plants, which remain the only source of utility-scale electricity on the island.

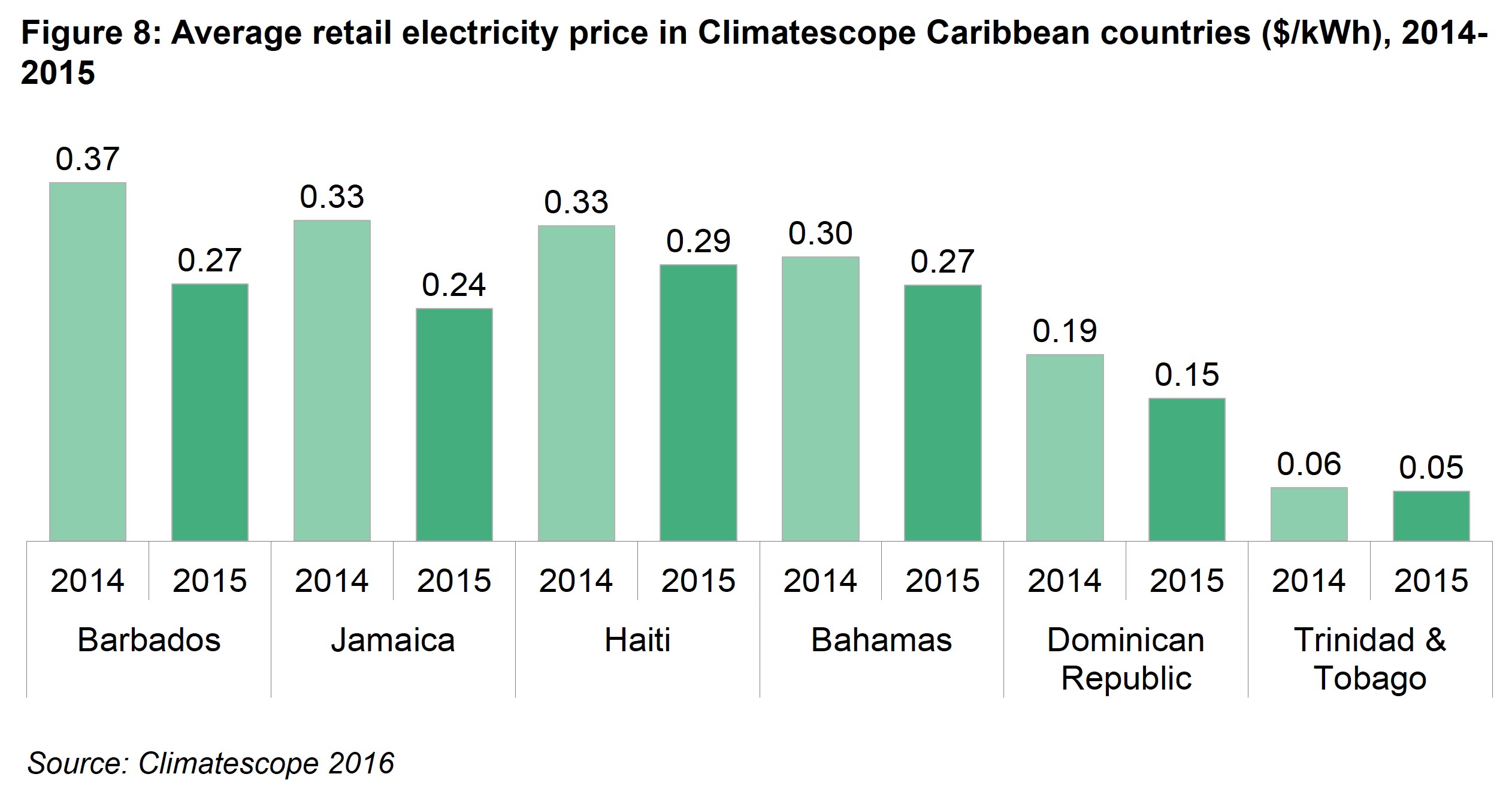

Lower prices for oil have prompted substantial cuts in retail electricity rates in the Caribbean and most of Central America, but prices overall remain high (Figure 8).

Finally, of seven Central American countries, five saw reduced electricity rates in 2015 due to lower fuel prices. Only Panama saw an increase – mainly to cover costs of excessive thermal generation caused by the 2014 drought. Unlike most of its regional neighbors, fuel prices have a small impact in Costa Rica’s power tariffs rate, as the country was able to meet 99% of its power demand needs with renewable resources (including large hydro) in 2015.

1 Climatescope covers 10 countries in Asia and 19 countries in Africa and 3 in MENA.

Average scores

- %% region.name %%

- %% region.score[0].mean | round:2 %%

| Regional rank | Global rank | Country | Global score | Trend | Topics: 0.0 - 5.0 | Grid |

|---|---|---|---|---|---|---|

| %% country.score[0].regional_ranking | leadingZero:2 %% | %% country.score[0].overall_ranking | leadingZero:2 %% | %% country.name %% States | %% country.score[0].value | thousands:2 %% |

|

%% country.grid %% |